Corporate social responsibility isn’t just good for people and the planet: CSR helps shareholders, too, according to a direct comparison of similar companies.

Corporate social responsibility isn’t just good for people and the planet: CSR helps shareholders, too, according to a direct comparison of similar companies.

Researchers at the Harvard and London business schools carefully paired 90 companies that followed CSR practices with 90 similar firms that did not. For example, their journal article says, “the two groups operate in exactly the same sectors and exhibit statistically identical size, capital structure, operating performance, and growth opportunities.”

Among the high-CSR practices were:

- A board explicitly made responsible for sustainability, tending to have a committee dedicated to it.

- Executive pay tied to “environmental, social, and external perception metrics.”

- Extensive external stakeholder engagement, from broad identification of stakeholders to information gathering to board reports on the results.

- A focus on long-term financial results, which attracted investors with a long-term focus.

- Efforts to “measure information related to key stakeholders such as employees, customers, and suppliers”—and to increase the credibility of these measures through audits.

- A tendency to “disclose more nonfinancial (e.g., environmental, social, and governance) data” to the public.

- Embedding CSR practices, rather than merely talking about them or “greenwashing” (only releasing information that makes the firm look good.)

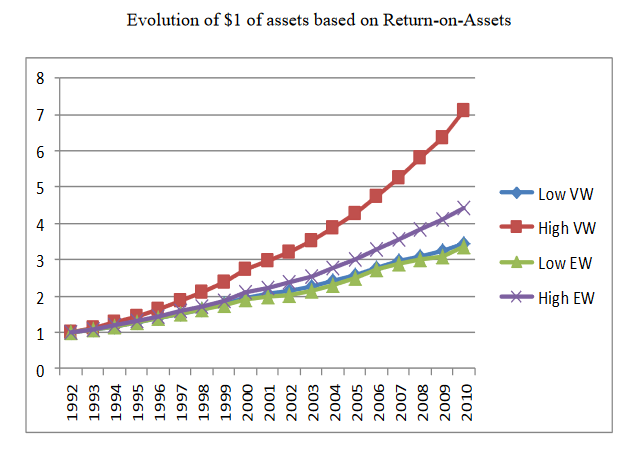

The results? A $1 investment in 1993 in the “High Sustainability” firms would have grown to $22.60 by late 2010, versus $15.40 in “Low Sustainability” firms. Other financial measures showed similar results, as shown in this return-on-assets chart from the study:

The high-CSR firms weren’t as responsible as they could have been. From a list of sustainable people and planet practices the researchers checked, the high-CSR companies had only adopted 50%. But the low-CSR firms used only 10%.

In summary, the scientists write, high-return “organizations that voluntarily integrate environmental and social policies in their business model represent a fundamentally distinct type of the modern corporation, characterized by a governance structure that in addition to financial performance, accounts for the environmental and social impact of the company, a long-term approach towards maximizing (long-term) profits, an active stakeholder management process, and more developed measurement and reporting systems.”

Source: Eccles, Robert G. and Ioannou, Ioannis and Serafeim, George, “The Impact of Corporate Sustainability on Organizational Processes and Performance” (December 23, 2014). Management Science, Volume 60, Issue 11, pp. 2835-2857, February 2014. Available at SSRN: https://ssrn.com/abstract=1964011 or http://dx.doi.org/10.2139/ssrn.1964011.